Get Your Free South Dakota Car Insurance Quote

Compare & Save: Get the Best Car Insurance Rates Today!

Why Choose Cheap South Dakota Auto Insurance with Easy Car Quotes?

Finding cheap South Dakota auto insurance is simple with Easy Car Quotes. We connect drivers across the Mount Rushmore State with top-rated insurers so you can compare policies side by side. Whether you’re a student at SDSU in Brookings, a family in Sioux Falls, or a business owner in Rapid City, our platform makes it easy to:

Compare multiple quotes instantly to find the most competitive rates in your specific South Dakota zip code.

Unlock discounts for safe driving, bundling home and auto, or being a student with good grades.

Meet South Dakota’s 2026 minimum requirements, which include 25/50/25 liability limits ($25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage).

Maintain mandatory Uninsured and Underinsured Motorist (UM/UIM) coverage of at least 25/50 to protect yourself against the risks of drivers without sufficient insurance.

Save money while protecting your vehicle, family, and personal finances.

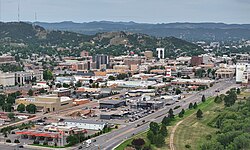

Start saving today with cheap South Dakota auto insurance tailored to Sioux Falls, Rapid City, and Aberdeen drivers. From the heavy commuter traffic on I-29 to the scenic stretches of Needles Highway, we ensure your coverage meets the 2026 standards while keeping your monthly premiums low.

Easy Car Quotes South Dakota

Your Source for Affordable Car Insurance

Driving in Sioux Falls requires adhering to South Dakota’s strict 2026 mandates to avoid immediate license suspension and fines that can range from $100 to $500. As the state’s primary transit hub, Sioux Falls presents unique risks—from the heavy congestion near the I-229/I-94 interchange to high-pedestrian activity near Falls Park. Whether navigating sudden prairie blizzards or dense tourist traffic near Rapid City, standard policies often overlook these local demands.

With South Dakota law requiring Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage to protect you directly, Easy Car Quotes makes it simple to compare top-rated insurers in minutes. We help you find a policy that meets South Dakota’s 25/50/25 requirements, providing a vital safety net for the busy streets of Sioux Falls, Rapid City, and Aberdeen.

High Traffic Volume in Major Cities in South Dakota

Finding cheap South Dakota auto insurance is simple with Easy Car Quotes. In high-traffic hubs like Sioux Falls, Rapid City, and Aberdeen, heavy congestion on the Minnesota Avenue corridor, West Main Street, and Highway 12 increases accident risks, making reliable coverage a necessity.

Whether you’re a professional navigating the Sioux Falls Financial District or a resident commuting from Rapid City near the Black Hills, we help you instantly compare top-rated insurers. Secure a policy that meets South Dakota’s updated 2026 25/50/25 requirements and mandatory UM/UIM coverage while protecting your finances against the unique demands of South Dakota urban driving—ensuring you stay legal and covered whether you’re heading to Mount Rushmore or cruising through the Badlands.

Still Have Questions?

Read our FAQ's to learn more about South Dakota car insurance and how Easy Car Quotes can help you find the perfect coverage.

SD requires Liability (25/50/25) and UM/UIM BI coverage (25/50).

No, Personal Injury Protection (PIP) or Medical Payments (MedPay) coverage is not required by state law.

Compare quotes via EasyCarQuotes. Maintain a clean driving record. Ask about discounts (multi-car, good student, safety features). Consider higher deductibles for optional coverages like Collision and Comprehensive.

Driving without insurance is a Class 2 misdemeanor, potentially leading to fines, jail time, and driver's license suspension.

Yes, you typically need to provide proof of insurance when registering a vehicle in South Dakota.

Contact Us Today and Unlock Maximum Savings!

Get a free Auto insurance quote today and see how much you can save!